Title: Die Kunst über Geld nachzudenken

Author: Andre Kostolany

Pages: 237

Hi all,

The third book I decided to read again is this German financial advice book. I have covered it previously under review 044-2020, but since that is already a while back I decided some advice from a former successful investor could do some good when the markets are currently undergoing some turbulent times.

He might not be well-known to the English-speaking world, but he is (or was, since he has passed away two decades back) often prominently featured alongside successful investors Warren Buffet and others.

The book is written in German, but I have translated the titles in English into the following chapters:

- Preface (pg.9)

- Andre Kostolany was born in February 1906 and passed away in September 1999. He was born in Hungary and first came into the stock exchange business in 1917 when his father sent him to learn the business from his uncle in Paris, France.

- Thus, during his lifetime, he has seen what the economic consequences were before the World Wars, during and after and then the prolonged period of peace after World War 2, with the exception of the wars fought by USA (Korea and Vietnam) and other smaller nations.

- No doubt he would have seen quite a number of bubbles (some bigger than others) and doom sayers’ predictions due to some current war or drop in well-being of livelihood.

- Through and through, he was a strong supporter of capitalism, he never gave advice when asked, with the exception of one piece of advice: Invest in yourself, as well as the education of your children.

- The fascination with money (pg.15)

- There is no doubt, money is the medium that allowed us to advance and progress our societies to what they are today.

- He does not deny that capitalism has its downsides, but felt that the system of socialism offers each person an equal portion of a small cake, whilst capitalism offered varying portions of a larger cake.

- He thought that before we should be allowed to deal with money, we should learn to understand money. The same rule applied for people that wished to enter into the stock exchange:

- Rule 1 – Don’t follow the climbing prices on the stock exchange, but go towards them when they fall

- The method here is to invest anti-cyclical

- Before investing, however, one should know whether the company is good for it, and the downturn is merely a short-term reaction of people to bad news

- Rule 1 – Don’t follow the climbing prices on the stock exchange, but go towards them when they fall

- Another important thing to remember is that money is the medium through which we are able to realize multiple things (i.e. consumer spending, etc.). It itself does not have any intrinsic value. In addition, money laying idle on the account does not result in multiplication. Therefore, to build wealth, we need to use our monetary resources effectively.

- Rule 2 – To build wealth we need to invest and thus engage in some risk

- Here, he does not mean invest in all kinds of items and products, but follow a simple and clear strategy and then sticking to it. Making some adjustments along the way (i.e. entering slightly lower risk due to ageing, or moving away from high equity positions and more dividend-paying companies) are relevant since the economic reality changes.

- Rule 2 – To build wealth we need to invest and thus engage in some risk

- The next thing we are confronted with are the multitude of experts and their investment products. Everyone is sure their product (real estate, precious metals, options, stocks, bonds, e-currency, etc.) is the top investment. This information overload can make anyone dizzy. They tell you they can predict that their model will bring in the greater returns.

- Rule 3 – Speculation is a form of art, not science.

- The fall of LTCM is the best example to this. The two company starters were highly qualified and even held the Nobel prize for their Black Scholes model. Their model did work for a short time, but in the end it went bust. Showing, that no one truly knows what the future will hold, which asset will be the best investment, etc.

- Rule 3 – Speculation is a form of art, not science.

- My stock exchange zoo (pg.29)

- Kostolany himself was a speculator. Not the kind that bought and sold within a short amount of time. Neither was he a long-term investor, who held onto his investments deep into the horizon. He was someone in the middle. He looked at what was happening in the world economies, fiscal and monetary policies and many other data points and then speculated whether the bonds, share prices or prices of some other investment would profit from that (bull) or would suffer a hit (bear). Then, he invested and held onto his investments until he realized the markets either recovered (from a bear market) or were becoming over-heated (bull market) and then cashed in his profits and went after a new investment.

- He advises that whether one should become an investor or a speculator would depend on two factors:

- A persons financial position

- The message here is that one should not use money to invest if one cannot afford to lose it. The money that is invested (even in the safest investments – blue chip companies, bonds) should be money you can afford to lose some of in case the economy suffers a downturn.

- Money that will be needed in a few weeks/months might not be ideal to be invested since you might be caught in a downturn, which temporarily lowered the value of your investments.

- Investing should be for the long-term in order to really benefit

- A persons character

- If it is difficult for one to speculate against the market and hold out, since the prices may continue to go in another direction before it eventually goes according your prediction, then it would probably be better to become an investor.

- In particular investors for a bull market and not a bear market.

- Rule 4 – Invest only what you can afford to lose

- A persons financial position

- The next relevant consideration is through whom or with whom you are making your investment. Companies offer customers and potential customers packages that seem to offer terrific returns. However, bear in mind, they also need to earn money in some form and manner. Whether it is p/order you make with them (to buy shares), based on the performance of the portfolio for the year (active or passive portfolio managers), or some other means, in some way they need to earn money for their employer. Therefore, before entering into any investment, know what you pay.

- Along with that, one should not put all ones investments in one single item, but spread over multiple items, to stave off some of the risk we face from each investment.

- Rule 5 – Diversify your investments

- Another matter that he emphasizes is that experience is the best teacher. This doesn’t mean we should all make the riskiest and silliest investments to learn that they are not good. We should learn from others, as well as from investing ourselves. We feel much more emotion when we lose something than when we gain something and therefore it will set us up to make better decisions in the future.

- Speculate, with what? (pg.49)

- He goes into a discussion of the different kinds of products (Bonds, Shares, Precious Metals, Other Resources, Properties, etc.) there are, how one can make money from each one and which ones are considered too risky for the layman, since they require frequent attention, which is not something that everyone wants to give when it is not interesting to them.

- It is true, some assets sometimes perform better than others during certain periods, but one investment he considers a good investment for those that don’t want to make investing their profession, is investing in shares. You invest in value companies that produce something that is needed everyday by someone and not invest in something where you speculate that the value of the item may be worth more in the future by holding it back for a few years. Only real knowledgeable people know what a fair price is of these assets in a given time since the prices are not necessarily traded actively or they are traded so actively that the price is prone to fall sharply for the simplest of bad news.

- The stock exchanges, nerve-wrecking systems of the economy? (pg.71)

- In this chapter he briefly discusses how the stock exchange came into being in the 17th century Holland.

- Another important factor he brings up is that investing not only allows one the opportunity to let one’s invested funds grow in value, but also have them fight the inflation in the economy. Whilst money laying idle in the bank account loses money due to the printing of money from governments, your investment money holds a share in a company that earns more of this additional money, thereby enhancing their worth in the newly inflated world.

- Over the long-term – both the economy and the stock prices grow.

- Over the short-term – the economy grows slowly and the prices fluctuate up and down frequently.

- What makes the prices tick? (pg.83)

- Whenever the prices of stocks move up and down, analysts try and explain the different factors and variables that were responsible for the movement. That may be so, but it those are not the only factors.

- What it ultimately boils down to is Supply and Demand.

- When the prices rise, there are more shares requested to being bought, at a certain price, than sold.

- When the prices drop, there are more shares made available to being sold at a certain price, than bought.

- If there are more buyers/sellers, then the price will continue to rise/fall, until a price is reached where players are not buying as frequently

- It may thus seem that the price is higher because interest rates have dropped (making it cheaper for a business to borrow and thus expand), but if no one reacts to the information, then the price will be unaffected by the news. It is what we as investors and speculators guess could happen in the future based on the information made available.

- Another important thing to bear in mind, there are always two legs to the transaction. A buyer and a seller.

- The factors that impact the long-term (pg.87)

- When you make an investment/speculation in a company, the hope is that it will grow in value over time and potentially also deliver returns, whilst not impacting the means of the entity to continue to flourish.

- Nothing in the future is certain, and therefore the factors that you can ascribe to impact your investment over the long term are the following:

- Whether there is war or peace

- When there is war, money in the bank or investments of any kind all have a high risk of becoming worthless (especially money in the bank). Therefore, being at peace is important for your investments to grow wealth.

- Whether the economy is set up without too many obstacles and those that it does come across can be overcome

- Like Buffet, he is not a fan of investing in precious metals. Nor is he a fan of implementing a Gold Standard (i.e. all currency is covered by gold, stored in a vault somewhere).

- This does, however, not mean that he is an ambit supporter of endless money printing as seen in the 20th and 21st century.

- He is a supporter of an inflationary economic model, which allows additional money to be introduced to be spent by companies to make them grow and be able to deliver more output. Since it is inflationary, it is our responsibility of citizens to invest our money so we can participate in the firms growth and not suffer the hit on the purchasing power. However, the inflationary model should be kept in check, not let run amok as has happened on multiple occasions in the latter two centuries.

- Whether there is war or peace

- The factors that impact the medium-term (pg.99)

- If you look at a chart of an index that stretches over many decades, you will notice that it goes up in most cases. Thus, over the long term, the companies are able to absorb the hits they suffered during individual periods. If you zoom in, you will see that within individual year and months, the chart show more up and downs.

- We move on to the medium term factors that impact the economy:

- Money

- For share prices of companies to rise, money needs to be available to buy new shares. If money is available in large quantities (by the people, credit card companies and the government) there is means to rise the prices. When the people/government have less money available for investing (since money is currently bound into stocks, or simply spent) then prices cannot rise further. It will then be those long-term investors, who saved money to buy them cheap once people sold them in masses, then they will be ready to pay for them.

- Psychology of the Masses

- The second factor, and not the least important, is the psychology of the people. They determine how high or low the prices will be since they decide at which price they will continue to buy or sell for.

- Money

- When both these factors are positive, the stock prices go up, and vice versa.

- The psychology of the stock exchange (pg.121)

- On the field, there are two kinds of investors. On the one hand are those that don’t let any kind of news (bad or good), their emotions, nor the psychology of the masses impact the decision they take to invest or sell — Hard Investors. On the other hand, there are those who are easily influenced by news, emotions or others to sell or buy investments — Soft Investors.

- The former generally follow the anti-cycle

- Whereas the latter follow the current cycle and thus end up buying when prices rise and also when they fall those prices considered to be fair valuations.

- Someone that a Hard Investor is one that is in possession of an equilibrium of the following four Gs:

- Geld — Money

- Rule 6 – Only invest with your own money, never with borrowed money

- Gedanken — Sense

- Geduld — Patience

- Glück — Luck

- Geld — Money

- The next thing the investor should understand is that the stock prices run in cycles. During some years, the economy is not doing as well, which causes prices to fall, (one reason being that people need money to pay for things and therefore liquidate their investments — more sellers than buyers). During other years, people have more money available once again, to spend on different things, even the stock market.

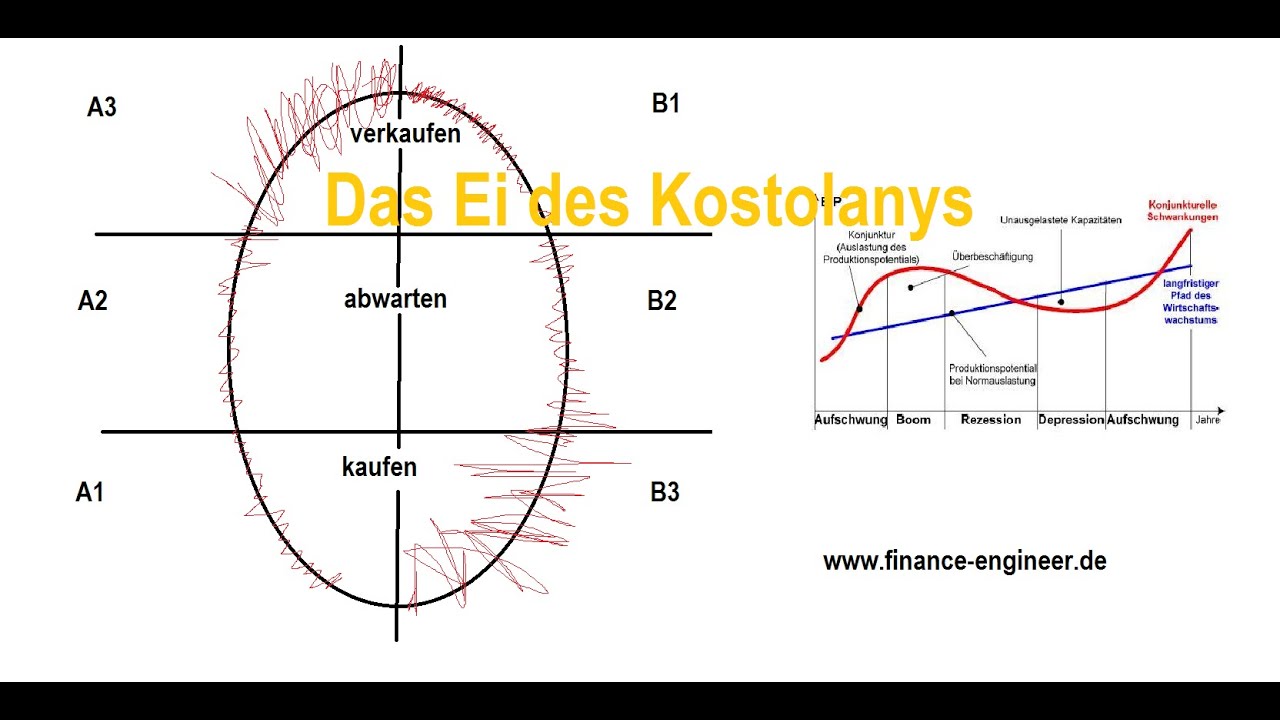

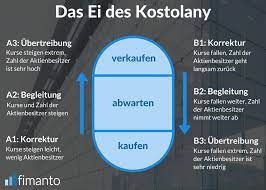

- In the two images, it is visible that during certain points of the economy, it is advisable to sell an investment, during some to hold and some to buy. The Soft Investors mostly fall amongst those who buy at inflated prices, and sell at below cost price. The Hard Investors on the other hand invest anti-cyclical, hold and then sell when everyone is buying at inflated prices and vice versa.

- Be advised, this is the approach followed by him, who speculated with companies and other investments over many months or years.

- For those following the Value Investing approach, the thing to figure out is when prices of stocks are cheap or reasonably price so one may acquire a good company at a cheaper price, thereby not overspending for a company.

- On the field, there are two kinds of investors. On the one hand are those that don’t let any kind of news (bad or good), their emotions, nor the psychology of the masses impact the decision they take to invest or sell — Hard Investors. On the other hand, there are those who are easily influenced by news, emotions or others to sell or buy investments — Soft Investors.

- Information jungle (pg.183)

- Making an investment is not merely something that can be done again with the same money when you made an error. If you made an error, then then money you worked for months to accumulate is gone.

- Therefore, it is of the utmost importance to gather information from multiple different sources and not rely on one or two. Each individual source will argue either for or against an investment at the same time.

- Rule 7 – Collect information on investments from multiple sources

- Since there are some that say prices will go up, whilst others say it will go down, you know that they have come to this conclusion based on their expectations for the future of the company, due due some recent events. However, since the future is uncertain (meaning that the prices may fall/rise for the given or different reasons), you are not required to know everything before you make an investment decision. More likely, you may just be intimidated not to invest at all, due to all these different variables.

- Rule 8 – You don’t need to know everything, but beware of it.

- Stock picking (pg.205)

- There are multiple different companies, ETFs and indexes you can invest in. Each one has its own risk classification, thus putting your funds either at greater or lower risk to dramatically rise/fall or only slightly day by day.

- It is advisable to understand what you wish to achieve with making the investment. Depending on the goal, different investable items are appropriate.

- Invest for retirement

- Invest for your child’s college

- Invest for a future purchase (i.e. car, house, etc.)

- Invest to make quick gains

- etc.

- etc.

- The money managers (pg.217)

- To those who wish to dare it (pg.225)

- Where you wish to make an investment to grow your wealth and aid you in your later years, the only advice that is appropriate is to start as son as possible.

I really enjoyed reading through his lessons once again, and refresh some of the theories he brought out from his book: Das Ei von Kostolany. It has reminded me that even during difficult times, there are some good decisions that an investor can make for the long-term to build his wealth and aid his future success.

Summary:

The book is informative and gives clear guidance that during every economic cycle, we can still make good investment decisions for our portfolios. It has emphasized the importance of being a Hard Investor and not let yourself be guided by your emotions or other external factors when making investment decisions.

The book deserves a rating of 4.7/5.

Have a good weekend, and happy reading! 🙂