Title: Investing the Templeton Way (The market-beating strategies of Value Investing’s legendary bargain hunter)

Author: Lauren C. Templeton & Scott Phillips

Pages: 268

Hi all,

I have finally come around to read the book that I was gifted for Christmas. Though I have managed to gain a good insight into the topic, I always still indulge in different investment books to see if there is something else that may be learnt. Whether it be something I would not do or whether it is something that I didn’t think of before, but has now grown of greater importance, I believe I always take something away from a book.

The book was written and told by a family member of Sir John Templeton, who himself is portrayed to have been a successful investor and managed to find value in companies and countries that others were not looking at.

Below each chapter is a brief extract of some of the important messages I took from the book.

The book is made up of the following chapters:

- Foreword

- The most important lessons the author takes away are:

- Lesson 1 – Invest at the maximum point of pessimism

- Lesson 2 – Invest to include a global portfolio of stocks and not only from a single nation

- Lesson 3 – There is only one reason why a stock is offered at a bargain and that is because other people are selling.

- Chapter 1 – The birth of a bargain hunter (pg. 1)

- (1) John Templeton became who was because of the people and circumstances surrounding him throughout his lifetime. He learnt the values from his parents, learnt that the economy experiences both and downswings continuously, but the reasons behind them are different.

- (2) From his father he learnt the practice of buying an asset when it is at its most pessimistic value, due to the people having declared it to be such. However, he learnt to look beyond the present circumstances and see its value in the future to understand that a low value is in most instances only temporary.

- (3) He also learnt that he should try and invest as much of his earnings as possible and therefore lived a frugal life (i.e, no conspicuous consumption in your early years). However, this does not mean he never bought nice things. He and his wife simply looked for nice things and bought them when they were currently valued at a pessimistic value.

- (4) He disliked credit and therefore always worked to settle any acquisitions in cash. Credit meant paying someone else interest and this meant having less to invest himself.

- (5) His parents brought him and his siblings up in a laissez fair parenting style. It was important to them that they be curious of the world around them and then investigate things. This led him to adopt a “can do” attitude towards life.

- (6) At his young age he managed to save a lot, which he used to travel to multiple places around the world. Whilst there, he studied their cultures, histories and economies, which would help him in the future to have the courage to invest internationally, when everyone else only knew their own country best.

- (7) An outstanding characteristic that he attained was to have common sense and wisdom, which he would apply to his future investing decisions when there were problems in an economy / company / country. He knew to look beyond the present and that problems were mostly short-term which was what caused people to make irrational decisions.

- Chapter 2 – The first trade in maximum pessimism (pg. 23)

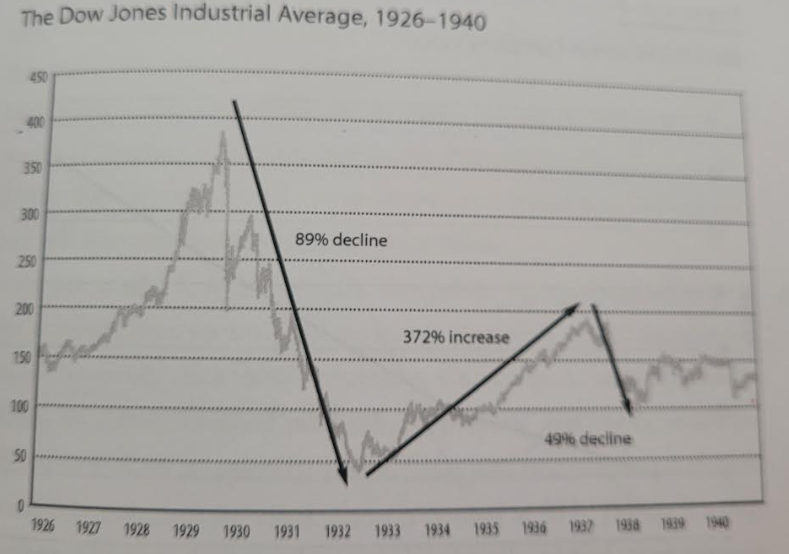

- The Great Depression (1930s) of the USA made some hard dents in the lives of the people around the world. During the roaring twenties (1920s), people had invested and overinvested in the stock market, because the share prices only seemed to go up. In the aftermath, the stock prices took a strong hit. People were financially and (most importantly) psychologically hit by this change.

- This would appear to be a maximum point of pessimism.

- However, the underlying value of the companies that people had invested in did not necessarily change with the fall in share prices. Companies had an intrinsic value, which is their true worth and not the worth perceived by the market. Some investors, as John Templeton, had known of this and the Great Depression therefore presented one of the best buying opportunities for them (see below):

- .

- From the graph above, it is clear that the market did bounce back after a few years.

- Therefore, it is important to understand that the value of the company moves independently from the stock price. In addition people sell their position for various reasons, and mostly those reasons have little to do with what they believe the new value of the company to be (for example they need cash to pay for a medical emergency, or unexpected damages, etc.).

- Bargain hunters should be professional skeptics. The broker from whom they buy is often paid on commission. Therefore, he is not interested that your shares will grow in ten years, but rather to find a hype, find a company and sell it to you.

- You need to do your own research into the company. One does not need to be a professional valuer to find a good company. However, one should start by understanding what the financial statements (over a period of 5 – 10 years) are telling you about the company’s performance.

- You should also never make an investment decision when emotions play a role. Emotions can make us do things that we would not have done when we were of sound mind.

- When WW2 was about to break out, people still remembered the events of the WW1 and therefore were not necessarily thinking of investing as much. John Templeton believed that the US would also eventually become involved in some way (either as a supplier or as a combatant) and therefore firmly held that the government would start ordering goods from all companies in the economy to add towards the war. Templeton therefore searched for companies that would benefit from this enhanced spending and which had the most to gain. He invested in many companies and also smaller ones, since he believed their gains (share price) would be greater than the larger established companies who were already on a good price. This worked out and he subsequently sold those shares again once he believed the price to be too large.

- His lesson here is that one should not hold on to one investment strategy throughout all economic circumstances, but that one should also be flexible to adjust it for the short term.

- War brought forth some enhanced governmental spending, which happens infrequently, but can be beneficial for smaller companies who will benefit as much as the bigger companies. Also, the change in strategy was planned to be temporary. He planned to sell them since he did not see as much value (long term stock price gains) in them as the larger competitors.

- Chapter 3 – The uncommon common sense of global investing (pg. 55)

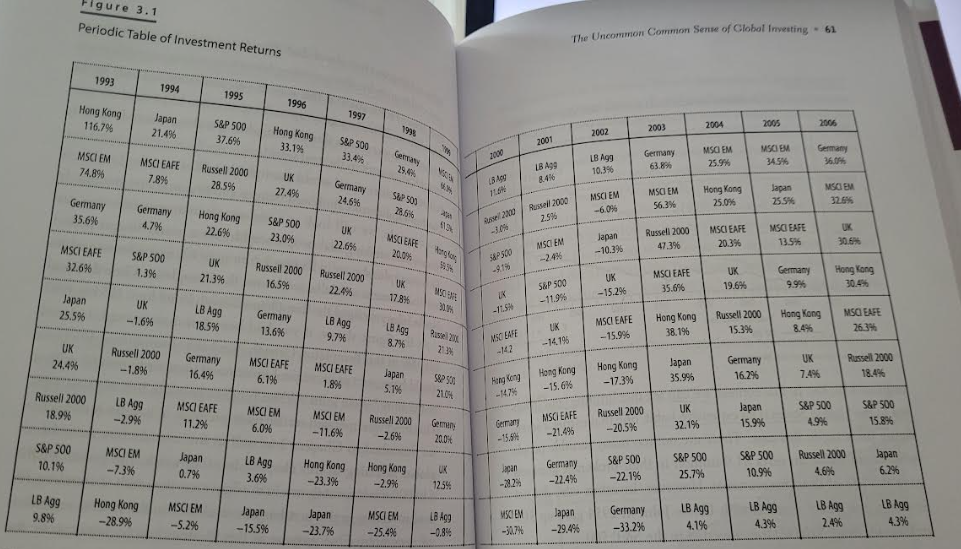

- A bargain hunter will not find the greatest bargains in one country alone. It is true, during different phases of the economy, the investor will find a bargain in one industry whilst another industry is going through a hype.

- However, limiting oneself to one country risks one not to benefit of an even greater bargain found in another country.

- .

- Shown in the table above is the return the different countries made during the different periods. If one only invested in one country the annual returns one would be benefiting from were smaller than having a diversified portfolio.

- Templeton therefore looked for a group of companies in countries that he had traveled to, knew, and which showed the greatest potential to recover.

- Some things he looked for in those companies were:

- P/E ratio

- P/E ratio (with the Earnings adjusted for the next five years)

- Any competitive advantage they held over others

- Some things he looked for in economies where those companies operated were:

- The savings rate of the people

- A country with a net export surplus

- A government with not a too high level of debt (that it cannot service)

- A political landscape for free enterprise and people being free to pursue their interests. A government that showed socialistic tendencies would present greater risks for assets being confiscated.

- “Free enterprise and the competition that results from it lead to progress. When competition is stifled, progress is too. “

- Chapter 4 – The first to spot the rising sun (pg. 81)

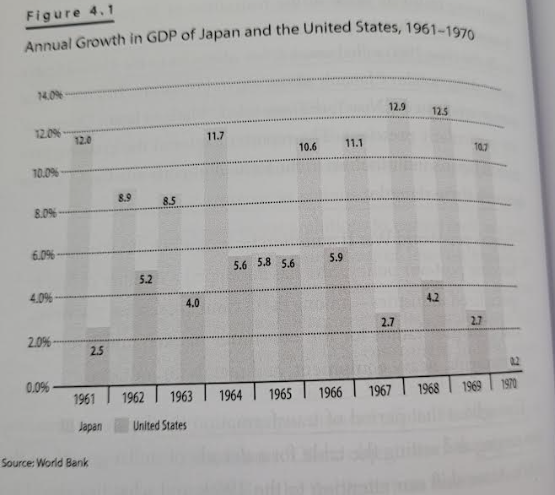

- In this chapter, the author goes into detail, how John Templeton found the Japanese economy (1950s – 1960s) to represent the one with the most attractive bargains in comparison to the other world economies. It was then only until the 1970s & 1980s that the other investors became attracted to their economy, by which time Templeton had made significant returns and was on the market once again to search for the best bargains.

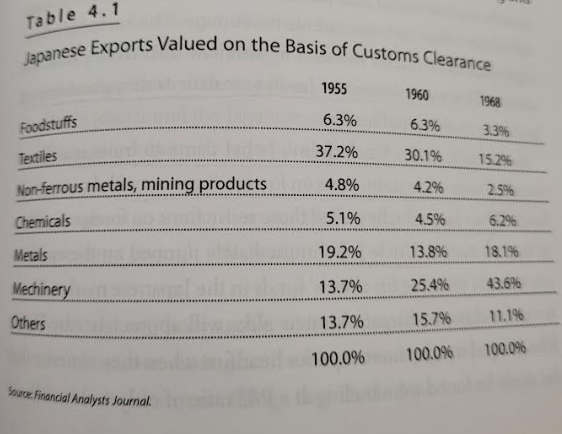

- Japan in the 1950s had just emerged from the WW2 and was looking to rebound its economy and become a world player. Its economy first started off with the manufacture of cheap products and textiles, which were then exported to the wealthier economies. Gradually it grew from shifting its exports from cheaper goods to quality industrial goods, which brought in greater returns.

- This would appear to be the point of maximum pessimism.

- Below can be seen the growth of Japan’s GDP i.r.t. the US:

- .

- Below can be seen the gradual change of the type of goods exported over the years:

- .

- During the 1950s he invested from his personal savings only since the Japanese economy had put in place capital controls on foreign investments. However, in the 1960s Japan lifted some of these strict measures and Templeton started to invest some of his clients’ money as well.

- Other US investors didn’t take the opportunity for likely two reasons:

- (1) Investing overseas was still a foreign concept

- (2) There was a negative public sentiment towards Japan and Germany. After all, why would one invest in those countries, since they lost the war.

- The point is that investors can create negative biases against stocks, industries, stock markets, and asset classes. Those biases serve as a set of blinders that keep investors from even considering bargain ideas.

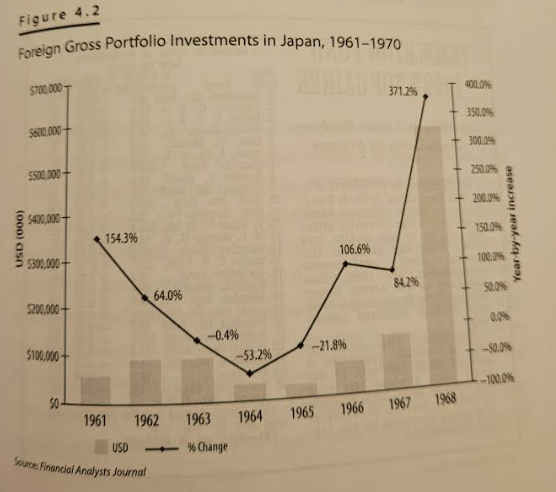

- Below is a graph that shows foreign capital flowing in to the Japanese markets:

- .

- What eventually happened in the 1970s were interest rate hikes in the US (one cause is likely the oil embargoes caused by the middle east countries).

- Investors then also had to come back to reality of their hyped investments in Japan, which caused the market to crash and with it, lots of ill informed investors. By the time this had happened, Templeton was already out of the market, since he had found his next bargains.

- Chapter 5 – The death of Equities or the birth of a Bull Market (pg. 108)

- The 1970s are marked to be one of the worst stock market years. One cause was the high interest rates, which offered a better return for some investors than the ordinary growth rates companies would offer. One magazine even went so far to publish this:

- .

- This would seem to be a point of maximum pessimism.

- One thing Templeton saw was that the companies had fairly low P/E ratios. Yet, Templeton understood, if the inflation was high, the cost to acquire the goods manufactured would also rise, which made the worth of the companies greater than their current valuation, which were only looking at values from the past quarter / year.

- Thus, he applied more than one approach to calculate the companies’ true values:

- P/E ratio

- Price-to-Book ratio

- The number of corporate take overs occurring in the economy by larger companies

- The number of companies buying back their own shares

- The amount of cash that was sitting uninvested by the big players

- Chapter 6 – No trouble to short the Bubble (pg. 133)

- In this chapter the author herself starts to come of age and see what was happening around her in the 1990s Internet hype. She then went to her uncle Templeton to hear from him what he has learned from the different hypes from the past.

- He explained that most of the euphoria’s had some common threads between them:

- The bubbles never repeat, but they do rhyme.

- Initially, when there is a new big thing, lots of people bring forth their ideas. Investors are not too familiar which one is likely to be successful, since they have nothing to base their judgements on and therefore there are a lot of IPOs and investors (i.e. many small players).

- Gradually, as time passes, many of these small players either disappear because their ideas never were realistic/useful or they are taken over by the other bigger players that have managed to establish themselves. Thus, the pool of companies shrinks.

- Eventually, the market is covered only by these bigger players and the expected earnings can now be based on better results from the first few years of operation.

- Another common thread is the level of optimism that the company holders have and the little risk there appears to be. They would display that we were living in a new age.

- Another common thread is the wealth-consumption effect.

- When people become day traders and perceive the wealth they are making from their new professions they then also increase their living standards, thanks to the new found wealth.

- This, however, has significant repercussions for the economy overall. Once the prices of stocks start falling, people will cease spending. Companies will earn less, show decreased returns, which will in turn trigger investors to sell again.

- The bubbles never repeat, but they do rhyme.

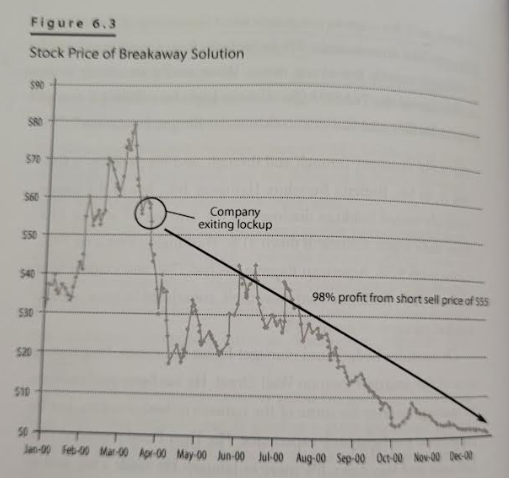

- So instead of becoming invested in these tech companies, he selected the companies that he wanted to short. However, he had to choose an exit point from his investments.

- Since it is difficult to predict when the shares would drop he applied another trick up his sleeve that would give him the best chance to time his exit well and make a proper return on his investments.

- The founders of IPOs usually have a clause (lock-in period) in their contract that prohibit them from selling some of their stock until a few months after going public (example, 6 months). Thus, Templeton timed that his shorts should be sold off just before this clause had been fulfilled and the founders started cashing in.

- Against his general rule, this was the point of maximum optimism

- See below one example:

- .

- Chapter 7 – Crisis equals Opportunity (pg. 171)

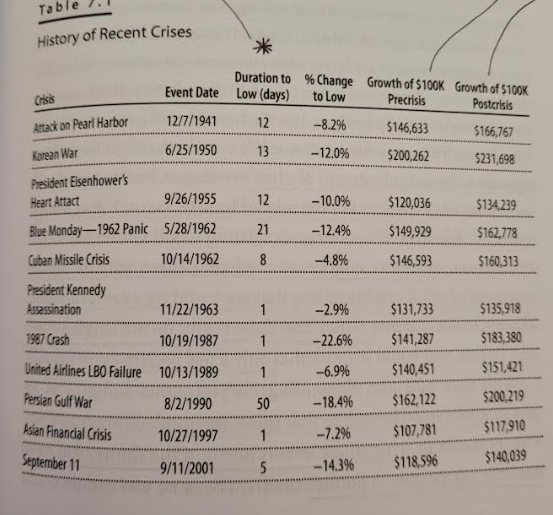

- In the next chapter, the author goes deeper into moments of crises that hit the world, and how it impacted the stock markets.

- The rules we have learned so far, and which apply also in times of crises are:

- (1) The best opportunities to capture bargains come during periods of high volatility

- (2) Bargain hunters search for situations where a large misconception of the company has driven the stock price down (i.e. difficulties present in the company and which are only of a temporary nature)

- (3) Always investigate stocks when the outlook is worst.

- History shows that crises always appear worse at the outset and that all panics are subdued in time. When panics die down, stock prices rise.

- The graph above shows various types of crises that were experienced by the US (column 1), the number of days this crises impacted the stock market before it recovered (column 2) and the value of ones portfolio had one remained invested during the crises (column 5 & 6).

- Since a crises hits unexpectedly and sometimes even only lasts for a brief moment, a stock investor will not be able to analyze all of the companies for the best bargains. Therefore, Templeton suggested the following approach:

- Before a crises hits, make a list of companies that you would like to buy, but who are currently overvalued.

- Look for companies with clean balance sheets (i.e. low & manageable levels of debt)

- Ratios you can use for this analysis are the i) Debt-Equity ratio and ii) EBITDA coverage ratio (interest coverage ratio)

- Look for companies that show a proper performance in their income statement

- Calculate these ratios and compare them with companies in the same industry

- Look for companies with clean balance sheets (i.e. low & manageable levels of debt)

- Always have cash on hand for moments like these so you can act quickly and buy bargains when they become available.

- Before a crises hits, make a list of companies that you would like to buy, but who are currently overvalued.

- The wise bargain hunter is a student of history.

- Chapter 8 – History rhymes (pg. 199)

- Before the Internet bubble, the Asian Bubble of 1997 hit the markets. Templeton used the opportunity to get into bargains that were presented by the economy of South Korea.

- Similar traits to those of Japan were observed since their emergence from the Korean War which sparked interest in Templeton to become an early investor.

- Chapter 9 – When bonds are not boring (pg. 225)

- In this chapter the author details how he went against the housing bubble by betting on bonds of a particular kind.

- Since interest rates were low, he acquired a bond with a free float interest rate that promised to pay a fixed interest amount every quarter/year. This may not seem attractive, since housing prices were soaring. Yet, he knew that if the bubble would burst, those prices would drop, financial difficulties would be experienced by many people, which would prompt the government to raise interest rates to balance inflation.

- The raise of interest rates would increase the value of his special bond.

- Chapter 10 – The sleeping dragon awakens (pg. 245)

- In this chapter the author discusses what John Templeton saw in China to be the next big economy and why he sought to invest here, since he saw the bargains in their economy.

- They had not just emerged from a war, as was the case for Japan and Korea, which made them interesting growing economies. China had gone through difficult economic times under the political regime that came in after the WW2 as well as subsequent political programs introduced by these political regimes.

- It was only when the politics experienced changes that the economy started to come on track to become one of the leading economies of the next century.

Although my summary doesn’t go into greater depth of the lessons, I believe that the reader will have identified what lessons were repeated in one way or another from the different chapters summarized.

Summary:

The book is easy to read, makes it very clear which investing lessons were important to follow during the different times of the decades and how being willing to act different from the crowd is the approach to follow when making investing decisions. Most important take away is for the investor to keep a calm head and make common sense decisions.

The book will receive a rating of 4.3/5.

Best wishes to you 🙂

Link (German): https://amzn.to/4qznQm1

Link (English): https://amzn.to/49d7UyO