Title: The Downfall of Money – Germany’s Hyperinflation and the destruction of the Middle Class

Author: Frederick Taylor

Pages: 359

Quotes:

- “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens…” – John Maynard Keynes

- “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency.” – Vladimir Ilyich Lenin

Dear reader,

This will be the second time of reading this book (also see review 019-2022) since I wanted to catch up on the topic of “loss of purchasing power” for a while now.

Why I was in the mood for something like this was because post-Wuhan virus the economies were deemed to experience some recovery when the military incident between Ukraine and Russia broke out. Another economic phenomenon the world economies experienced were high levels of inflation, high for multiple months and which were tackled by raising interest rates.

Since I hadn’t experienced something like this, I wanted to understand how a country underwent something event worse, a hyperinflation, so that one could understand how people were living their day-to-day lives.

The book is composed of the following chapters:

- Introduction (pg. 1)

- Chapter 1 – Finding the Money for the End of the World (pg. 7)

- Chapter 2 – Loser Pays All (pg. 17)

- Chapter 3 – From Triumph to Disaster (pg. 31)

- Chapter 4 – ‘I Hate the Social Revolution Like Sin’ (pg. 45)

- Chapter 5 – Salaries Are Still Being Paid (pg. 62)

- Chapter 6 – Fourteen Points (pg. 70)

- Chapter 7 – Bloodhounds (pg. 78)

- Chapter 8 – Diktat (pg. 89)

- Chapter 9 – Social Peace at Any Price (pg. 107)

- Chapter 10 – Consequences (pg. 124)

- Chapter 11 – Putsch (pg. 135)

- Chapter 12 – The Rally (pg. 145)

- Chapter 13 – Goldilocks and the Mark (pg. 156)

- Chapter 14 – Boom (pg. 169)

- Chapter 15 – No More Heroes (pg. 181)

- Chapter 16 – Fear (pg. 202)

- Chapter 17 – Losers (pg. 206)

- Chapter 18 – Kicking Germany When She’s Down (pg. 228)

- Chapter 19 – Fuhrer (pg. 244)

- Chapter 20 – ‘It Is Too Much’ (pg. 250)

- Chapter 21 – The Starving Billionaires (pg. 267)

- Chapter 22 – Desperate Measures (pg. 286)

- Chapter 23 – Everyone Wants a Dictator (pg. 300)

- Chapter 24 – Breaking the Fever (pg. 316)

- Chapter 25 – Bail-out (pg. 337)

- Afterword – Why the German Trauma? (pg. 343)

Money

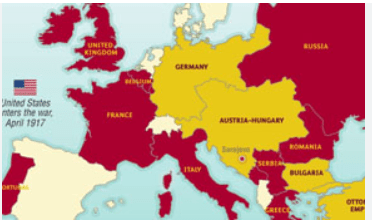

Germany’s king had borrowed money from his people (war bonds) to finance his war efforts right up to June 1918, since he would not receive external funding, whilst the Allied Powers (France, Great Britain) had borrowed money from neutral country U.S.A.

Before the war, the country’s permitted the exchange of paper currency for physical gold. When the war broke out, this exchange was “temporarily” suspended and propaganda was pumped up to convince the locals to hand in their gold reserves for the reliable paper currency. Since the government suspended the convertibility, it could now print more money for the war efforts than for which it had gold to back that currency.

Reparations bill

When July 1918 came around, Germany was so thin stretched, that it found itself in no position to continue the war. It was also inconvenient that the fresh faces from the U.S.A. had also shortly decided to join that all the gains made from August 1914 until June 1918 were handed over in the few months that followed.

An armistice was signed in November 1918 and the official peace agreement only followed in the early June 1919 (Versailles Peace Treaty). It would be in May 1921 when the new German Republic would be informed of the volume of the reparations bill that they would be required to pay to the Allied Nations.

Revolutions

From the time when the king had abdicated (November 1918) until the ending of the book (November 1923) the country had experienced a few attempts to be overthrown by different groups that envisioned a different kind of future for Germany.

- The first revolution was in November 1918, when the monarchy was overthrown

- The first attempted overthrow was from the left (Spartacists) which wanted to take control and rule the Germany in the Bolshevik style. This attempt was stopped.

- The second attempted overthrow became known as the Kapp Putsch, where former military men wanted to run the country in a dictator-style government. This attempt was stopped.

- The third attempt was made by Hitler with his small following in Munich. They wanted to take control over Bavaria and then march to Berlin. This attempt was stopped.

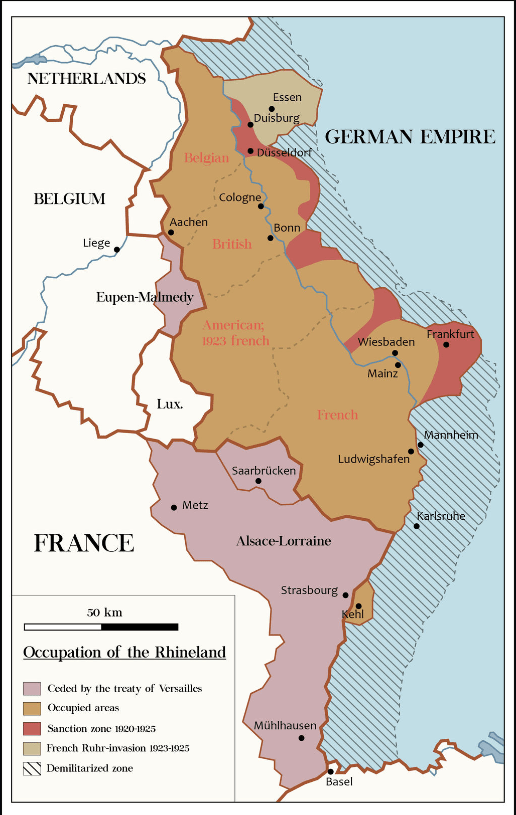

Germany struggled to meet its reparations payments, because its money became devalued in parallel. In the final months of 1922, the British and U.S.A. were coming to acknowledge that it was struggling and were willing to extend a hand. France, however, believed that Germany was not telling the truth of its struggles and was rather trying to get out of paying. Therefore, France and Belgian forces moved and occupied the Rhine territories (Essen, Dortmund, Duesseldorf, etc.), where Germany had its raw material mines, in January 1923. Considering the political tensions in the country, it easy to understand why this act played into the hands of political groups of the left and right that wanted to take over from the social democrats.

International markets

The Gold Mark had lost value on the international markets whilst the war was ongoing. However, after the war had ended, and Germany had lost, the currency would gradually lose value over time.

Some speculators (many from U.S.A.) thought of acquiring some currency, since they believed the country would get back on their feet and reclaim the title of a strong currency. This would not happen, unfortunately, since more money was spent to uphold the country and pay for reparations in parallel.

Stability

Since being informed in May 1921 what the reparations bill would amount to, the country, as well as many internationally acclaimed economists (John Maynard Keynes book “The Economic Consequences of Peace”), saw that the repayment amount and term (within a few months & years and not decades) would not be feasible, they decided to make their best attempts.

However, they would not raise interest rates to battle inflation, as France and UK were doing. Germany had seen a lot of internal struggles and political unrest that they feared that if they raised interest rates, this could trigger a political shift to another party, which would be even more disastrous. Therefore, they would continue paying with more money. More money would indeed devalue the purchasing power, but this could be used to make exports more competitive against other countries.

External nations had faith that the growing inflation of Germany was not too worrisome, since they had faith in their politicians. Especially their foreign minister Rathenau. When he was killed in June 1922, other nations had lost more faith in the country, from when on the currency would go spiraling out of control for months on end.

The new stable currency, the Rentenmark, would only be introduced in November 1923 under Chancellor Stresemann at the following exchange rate: 1 Rentenmark vs. 1.000.000.000.000 Mark. This effectively meant that it had eliminated a war bond sold previously to its people to become worthless. The only people that came out less scathed were people that had foreign currency or hard assets (house, precious metals, home decorations, food, etc.)

Fortunately in the end, all Allied Nations had come to the conclusion, that the best way for the future would be to rebuild Europe by assisting Germany with a loan to repay its debts to other countries and then work off that debt over the coming years.

Summary:

Our world has become so reliant and trusting of paper currency that we should never forget that difficult times can come upon us when we over-inflate the money supply in circulation. This is well illustrated in this book of a now-stable country that it can happen to any nation, even the strong ones that appear too-big-to-fail. The book is a little tricky to read, but the way all the different inputs are used together just shows that the inflation wasn’t a simple thing, but quite complex and had multiple effects on the country. It will receive a rating of 4.1 / 5.

Link (German): https://amzn.to/3L5sFV6

Link (English): https://amzn.to/4qxBshC