Title: Aktien Life Balance

Author: Lisa Osada

Pages: 211

Genre: Investing

Dear all,

The book I will be writing about is likely only available in German publication, yet it was also a well written book on the fantastic topic on investing.

The book is broken down into five main chapters and thereafter into sub-chapters:

- Chapter 1: Into the Stock market (pg. 13)

- The author started an internship at 19 for a champagne-like company. There, she was given the option to also acquire employee shares for slightly cheaper than their market sales price as part of her compensation. She didn’t know what shares were at that stage, but being a typical Swabian, getting something of quality for a little cheaper always sounds good. Thus started her journey to learn of investing.

- She learnt that saving money on the bank account is good but not good enough. Due to the changed monetary policy in many countries, people who save lose their purchasing power due to inflation (hidden tax). Therefore, saving in another way that somewhat preserved some of that purchasing power was needed. One of these methods was investing in stocks.

- After finishing her education and internships she wanted to start her real first job and with that she thought about buying a new car, a new BMW she had always wanted. However, after having obtained a better understanding how money invested and re-invested results in compounded returns, she realized how much on returns she would lose out on if she instead took out a loan to finance a new expensive car. Thus, she instead decided not to focus on consumption but investing. After all, as a young individual, time was on her side and had more opportunity to grow into something bigger.

- She had started investing via a savings plan and then only in German companies. She also invested in actively managed funds and in the process lost some money through fees. As she became more and more familiar with the topic she learnt she could also invest outside of Germany into more profitable entities and into cheaper funds that didn’t levy as high fees.

- She likely also would have gone through a phase where she thought that trying to time your purchase is how you would get rich. However, it became apparent quite quickly that the only determinants of the stock price are supply and demand. The reasons why people buy / sell in larger numbers can be due to various reasons (some due to recent news events and some for completely unrelated reasons) but in the end, the price is set by the largest number of players on one of the two sides.

- Chapter 2: Investing (pg. 56)

- She explains what ETFs are and how they are a beneficial investment for majority of the people who do not wish to know more about investing than they are required to know for them to invest money in ways other than low interest savings accounts.

- For share investing she explains that there are various sectors into which companies are categorized into (Energy, Raw Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Communication Services, Utilities and Real Estate) and that having a mix between branches and countries was essential to achieve diversification for your portfolio.

- Another important aspect to learn is to learn to become disciplined. Prices of shares will go up and down on a consistent basis. When prices have gone down, we tend to freeze up and wait until it goes back up again. Only when it has recovered do we consider to go and invest more. Yet, as investors, we need to learn to become comfortable that the prices will move in both directions and that we should still have the courage to buy when prices have dropped lower than before.

- What you should definitely consider doing prior to any stock purchase is:

- 1. Take your time – Research the company and sector you wish to invest in. View your investment as a real stake /ownership in a real company whom you are entrusting your money to.

- 2. Do not put yourself under pressure – You are not required to invest your money quickly. In fact, not every day is a day to invest, only few days during the year. On those days, when a good opportunity to buy the shares comes is the day when you should take on a share. Thus, learn to be patient with your money.

- 3. Set up your strategy prior to commencing your investing journey – Prior to investing, you should know what you are working towards (i.e. investing in dividend companies, companies with high growth, companies with stable growth, some risky and some less risky companies, etc.).

- After finding a company /companies that appear interesting to invest in, there are a few things that she takes a look at that forms part of her research:

- First, obtain a general understanding of the company by having a look at their company website and also reading (or watching) what others have to say of the company.

- Obtain an understanding of the sector in which the company operates. Are there many competitors or few, as well as in which countries they operate. The purpose is to understand where the company stands in the market and with that, how the company will be able to deal with big problems when markets experience rough times (i.e. will it be able to survive and thrive or is there a risk that it may go bankrupt, since it was standing on weak legs).

- Another good source is to read what other company analysts are writing about the company since they often have a deeper insight into sectors or multiple companies than you may.

- Prior to having a look at the company figures some other figures may also be of interest: i) how much is the market worth in which the company is operating, ii) what is the market capitalization of the company, iii) who are the holders of the shares, iv) are the products in the portfolio in such a strong position that customers would still buy the products, even when the economy is experiencing tough times.

- Next, she takes a look at the financials from the company financial statements, here, the income statement and balance sheet take the most attention.

- Some ratios and margins that interesting to observe include the following: i) Return on Equity, ii) Margins (i.e. Gross and Net profit), iii) Debt ratio, iv) Goodwill i.r.t. Total Assets

- The management report also offers insights of what happened during the year as well as where the CEO is planning to take the company in the following years.

- The Investor Relations page of a company website offers some of this information, but one is also permitted to request additional information that is permitted to be made available to the public.

- A big reason what has shaped her to follow a dividend strategy is the pension problem in Europe. The welfare states of this continent is risking of not being able to pay its residents a pension on which they can cover their living costs. Therefore, she is aiming to have high dividend pay-outs, but also only in companies that are destined to survive the next 10/20/more years so that she can re-invest most of these returns.

- She has also read the book that has influenced Warren Buffett and tries to apply some of these criteria, alongside her own, to choose individual companies:

- Sufficiently large enough company – companies earning roughly 1.000 million in revenues

- Low Price-to-Earnings ratio

- Low Price-to-Book ratio

- Making profits regularly

- Profits and Revenues grow over time

- Company pays out dividends

- Company shows a solvent balance sheet (i.e. manageable levels of debt)

- She emphasizes that the reader should at least take one thing with them from this book and that is the power of compounding interest. It is something we cannot grasp in the short term, but over the long term will show surprising results.

- She then gives a starter guide that anyone can start with:

- First, set enough money aside for any short-term emergencies. The purpose here is to have money for those uncertain expenses that pop up now and then so that you don’t have to sell some of your investments. You profit most, the longer you let your stocks grow uninterrupted in the market.

- Second, build a cash reserve which you will only utilize once opportunities on the market come up. The purpose is to build this pot for times of crises when stock prices drop lower than justified so you can buy good companies for cheaper prices.

- Third, set up a savings plan where a certain amount of money (or stocks) are automatically repurchased every month.

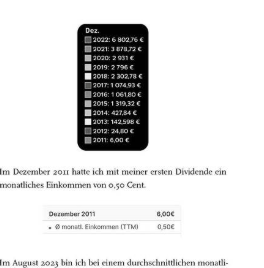

- She has shared her gross dividends that she has earned in the past and how they have grown through continuous re-investment:

- Chapter 3: 10 things I wish I had known sooner (pg. 180)

- Chapter 4: Looking beyond the plate side (pg. 203)

- Chapter 5: Closing word (pg. 209)

Summary:

Overall, it was an interesting read to learn of her journey onto the stock market scene. She made mistakes and learned from them. She has a clear strategy and stresses the importance of it to the reader. She stresses the reader to think of the long term and the power of compound interest over short term returns or consumption.

Most of the information was known to me, but it is good to read how others also went on a different path and came to a similar strategy and knowledge and understanding of how the stock market is to be understood. The book therefore takes a rating of 4.2 / 5.

I would also recommend it to anyone who is learning of investing or even those that are familiar with the topic but wish to read of someone else’s journey to this terrific field of study.

Best wishes 🙂

Link (German): https://amzn.to/4sgMZmV

Link (English): not available