Title: So werden Sie reich wie Norwegen

Author: Clemens Bomsdorf

Pages: 223

Hello all,

if there is one country that is making good use of its natural resources for the benefit of its citizens, then one such is Norway. Since discovering oil reserves off its coast it had two choices what to do with the money: spend it right away or save it and invest it for future generations when the reserves have run out.

You may think that they went with option two from the start, but that is incorrect. Initially they spent it as it was earned but within a few years they decided to change course and have since remained on that path.

The book gives a brief history how the fund came into existence and how the investment strategy changed over time. Initially, the money was only invested in bonds or similar products that had little risk. However, after a few years they re-assessed their strategy to invest also in securities since the purpose of the investment was to benefit the future generations. Thus, long-term investing would be best suited to share investments too. Many years later, around the time of the Finance Crises of 2008, the fund updated their strategy once again to also include some property investments.

Also, when they made investments in shares and bonds there were strict guidelines in which countries and companies they could invest, which initially was only in blue chips and developed nations. However, this was later revised again so that investments could also be made in companies not as big as blue chips, but with promising growth as well as companies from developing nations.

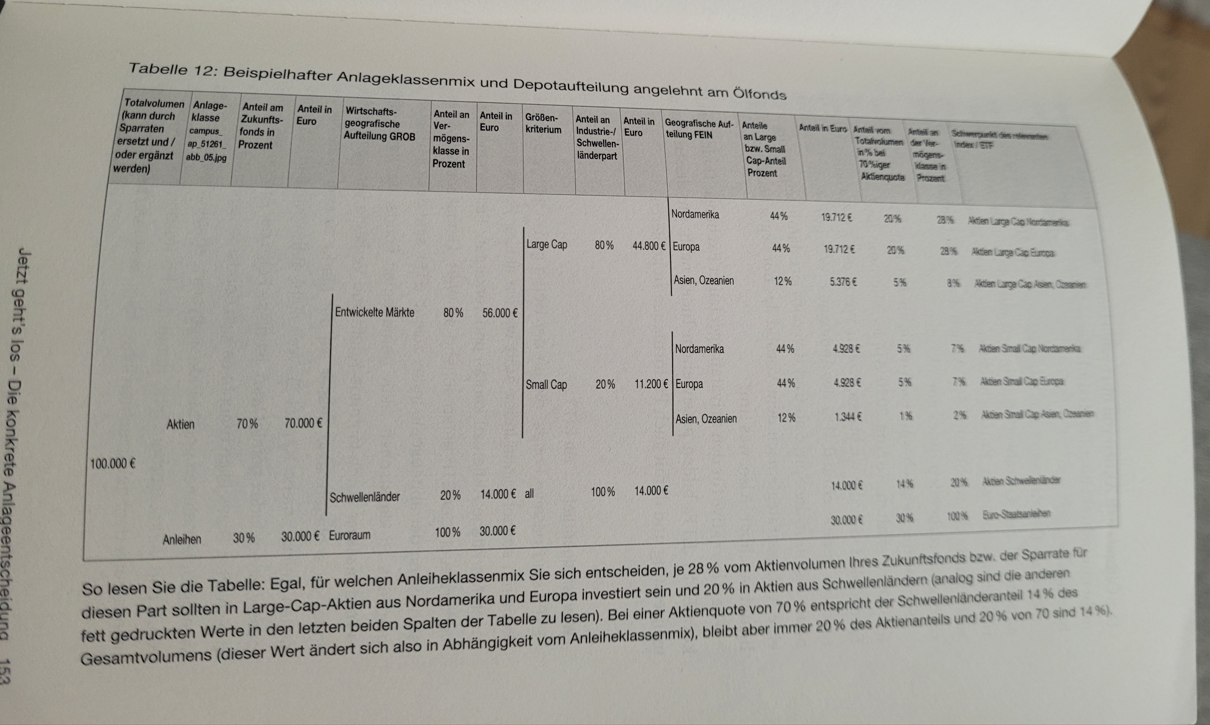

Eventually the fund worked out its strategy mix to be roughly like the below illustration:

The fund strategy has therefore been optimized multiple times to attain the best possible returns from different nations (developed & developing) with an appropriate risk mix (bonds vs shares vs large cap vs small cap).

Furthermore, the book then moves on to give the reader some investment principles to take home for themselves to apply for their personal portfolio, which includes some of the following in the various chapters below:

- Preface (pg. 7)

- Chapter 1 – No panic, success even in Crises (pg. 17)

- The power of compounded interest should not be underestimated, especially if you have a long time horizon available to invest.

- Chapter 2 – The Norwegian oil fund (pg. 26)

- The Norwegians avoided the “Dutch Disease” by investing all the returns of the fund in the foreign markets so that its own currency would not appreciate too much, thereby protecting its country’s competitiveness in the world market economy.

- The investments are strongly diversified so that there is no concentration risk in one country, branch, company or any other investment type.

- The oil fund initially used external experts to set up the fund and search for top investment opportunities. However, these experts’ costs ended up being very high and ate a significant portion of the returns. Therefore the fund was instead managed from internally and diversified stronger to balance risks.

- Passive investing in the long run allows the invested capital to return larger returns than actively managed funds.

- Even during troublesome times, the fund continued to invest. It didn’t stop and wait to find the right time to invest or find the right companies at their lowest value. It kept at it investing.

- Defining the time horizon of the investment, the risk appetite and the appropriate asset mix (shares, bonds, other).

- The shorter the time horizon the more sensible it is to invest in bonds where it is known which capital amount will be retrieved.

- However, short term investments bear a larger risk of loss of purchasing power. Therefore, where the time horizon is longer, it is more sensible to include more investments in shares that grow in value and target the loss of purchasing power by becoming more valuable companies.

- The fund uses a benchmark (market index) to compare its performance against to determine whether its selection is appropriate or needs to be updated in some time.

- Selecting stocks or ETFs for your personal portfolio should not consume too much of your personal time. Thus, research is key, but not too much research, since no one is capable of selecting winners all the time.

- Differentiate between unsystematic- and systematic risks that happen in countries and companies. The latter are defined as risks that impact all or most companies when certain events occur in the industry, whereas the former are risks that mostly only impact one / few companies when certain events occur.

- Chapter 3 – Which securities the oil fund holds and what you can learn (pg. 90)

- The biggest companies from most branches of the world economy will form part of the oil fund. However, no individual company will form a significant part of the fund. Therefore, if any one company is strongly impacted by a crises, this will not have dramatic consequences for the fund.

- The fund uses the FTSE Index to compare its performance and to identify further companies.

- The oil fund is strongly diversified on multiple fronts:

- 1) Industry- and Emerging Markets

- 2) Bonds & Stocks

- 3) Large Cap vs Small Cap

- The fund is largely passively invested than holding active investments. This reduces costs and the returns can continue to grow larger than with high costs.

- Chapter 4 – The Norwegian finance formula (pg. 119)

- For you personally, saving and investing means putting some of your available funds away from immediate consumption so it allows you to consume in the future.

- If you need to put money away for the short term, then those funds should not be invested. Only those funds that are not needed for the next 10 – 15 years should be invested, since growth can be seen only after many years have been granted for an investment to grow.

- Follow a “Buy and Hold” strategy and avoid the costly regular rebalancing strategy.

- Set up a savings plan where a fixed amount is automatically transferred to your savings / investment account every month. If there are circumstances that happen during some months that require slightly more funding (emergencies, wedding, etc.) then you can pause the plan temporarily. However, once resolved, you should resume the plan immediately.

- Use an index as a benchmark to compare the performance of your portfolio against the index to determine its strength and weaknesses.

- Chapter 5 – Let’s start (pg. 130)

- You need to determine what your risk appetite is before you start with a strategy. This is needed to determine whether you will be able to uphold your investment strategy even during turbulent times when your instinct to “save what’s left” could kick in and you cash out at a loss.

- Determine whether you will change the ratio of shares and bonds when you reach different milestones. After reaching a certain age you will require more funds (cash) to finance your daily life than when you are young and can still let the money grow without requiring cash from it.

- Keep a record of your portfolio movements. This will help to keep an overview of your investments and its performance.

- Summarize acquisition and sell dates, dividends received p/annum and p/company or ETF.

- Make notes of why an acquisition or sale was done.

- Chapter 6 – With Ethics (pg. 187)

- Chapter 7 – Learn from the mistakes of others (pg. 203)

- Start investing as soon as possible and don’t delay it to the next month /year, since shares show their true growth potential only over the long term and not the short term.

- It is important to perform some research behind each investment your are aiming to make. However, it is not wise to overinform yourself, since this can make your decision-making even more complex than it should be.

- Don’t make too many small investments, but make one large investment p/month to reduce costs and also to respect the investment decision. If you make multiple small (100 EUR) investments in 100 individual companies, you won’t mind making a loss on one company. However, this aligns with Warren Buffet’s rule to “Never lose money”, where all money should be put to productive use.

- Don’t fall for the home bias and not diversify in companies outside your home country.

- Don’t only invest in companies that are on the same continent as your home country. Also look further abroad.

- Chapter 8 – Making mistakes is human. Why so many private investors are not following the Norwegian formula (pg. 216)

- Afterword (pg. 222)

Summary:

The book is very informative of the workings of the Norwegian oil fund. However, it does not help to translate how the private investor can learn from it to apply it themselves. One does catch glimpses of small lessons that one could apply but it is not very concrete. The tips provided give readers the reassurance that investing is for the long run and returns should be expected only after multiple years of work. Therefore, the book will receive a rating of 3.7 / 5.

Link to buy (English): Not available

Link to buy (German): https://amzn.to/4pd4Ubu