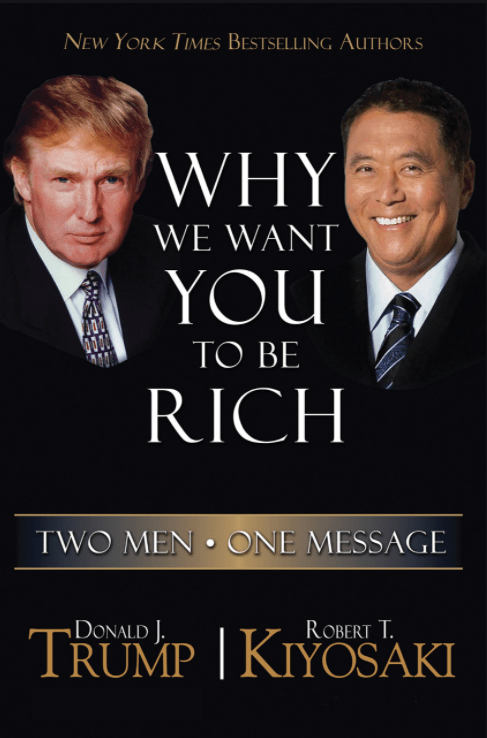

Title: Why We Want You to be Rich

Author: Robert T. Kiyosaki & Donald J. Trump

Hi there,

This is another addition to the books I have read of the Rich Dad Poor Dad franchise, and I’ll be very honest, I liked this book quite a lot. I understand that it was the first book that they co-authored together, and believe that you could all potentially learn something great from this.

The book is about 423 pages in length, spread around five parts, and making up a total of 29 chapters. Some of the chapters I felt weren’t too much of value, but why I believe they included the chapters was to give you background to the stories. For me personally, I prefer to get some background as well instead of just the lesson flat out. Reason for this is because I learn best when the lesson is presented to me in the form of an example.

The ultimate message I took from the introduction on why they want you to become better financially equipped was so that you can depend on yourself to take care of yourself whilst you still work, and eventually retire. Because when you put your trust in someone else (eg. public pension, public medical aid, etc.) where the situation is outside of your control and can change at any time, to take care of you, you are risking the living standard that you had hoped to achieve.

Part 1 of the book deals with why Donald Trump and Robert Kiyosaki wrote the book together, and this is broken down into the first five chapters.

- What they do highlight with these chapters, is that both of them wanted to write this book in a way that people will become educated and learn something, which they can use, and implement to better their financial circumstances

- The big think they teach here is the below pattern. In this pattern they show that the way they want to reach people is by changing their Thoughts, which in turn should lead them to spring to Action (to improve their financial education), which in turn leads to the Results. By reflecting on the results, we go back to our Thoughts that we changed to start off this process

THOUGHTS —> ACTIONS —> RESULTS (—>THOUGHTS)

- Therefore, in order to become better equipped, we need to change the way we think, because our current way of thinking may be what is holding us where we are.

- The way to get this process started is by considering what (1) goals/dreams we have for our lives. After envisioning that we then need to determine what is our (2) current financial and living situation. Then, we (3) identify the “problems” (ie. what is holding me back currently to live the life I would like to live) and then try and (4) find solutions.

- In another book of the Rich Dad Poor Dad franchise they went into more depth how this would work

- ie. by improving your problem-solving you are improving your financial IQ

- However, the important lesson here is not that you have achieved your goal, but the process you followed to achieve it. That is then your personal magic formula to solve your problems.

Thus, in part one, the imparting message is that you should rely less on others, and become more involved, and think more for yourself, because you know what you want (now and in future) better than any other passive third-party investor who invests for you.

Part 2 differentiates between the three different kind of investors, and why it is the one kind (the active investors) that manage to advance in the modern economy, and why the other two are falling behind. This discussion will take the length of eight chapters.

- The three categories of investors they have are (a) people who do not invest at all, (b) people who invest not to lose, and (c) people who invest to win

- With category b investors I understand that it includes people who make investments, but more on a passive side, compared to a category c investor that is actively making investment decisions. With the third category the investor takes an active role to learn different things about different investments, and then chooses the one he/she feels is at tolerable risk and will bring them the best returns. Whereas the category b investor doesn’t put in as much research and effort to select his/her investments, and just invests in established firms (little growth), or through a third party.

- In the next chapter it does bring the warning that everyone that wants to step into the active investor role should keep in mind that not every investment opportunity they come across is something that they should invest in. We need to evaluate the investment for what it is (industry, product, service, risk, our risk tolerance, returns, tax benefits, etc.) and then consider if this is within our interest.

- Thus, we need to have a clear goal/vision for ourselves, and then consider whether the investment would be something that would get us closer to that goal/vision or not

- Another difference between the category b and c investor is that the c investor can use leverage (ie. debt) to acquire his assets, whilst the b investor cannot since banks don’t lend money to invest in shares, whereas they do when the assets are tangible items. Thus, with leverage, the investor can buy assets with his/her and other people’s money to grow his asset portfolio, whilst the category b investor can only grow his investments with the money he/she sets aside to be invested.

- However, caution is made that the investor who wishes to use leverage to buy assets should first become very well educated on the investment, the risk, the returns, the current economic status, terms of using the debt, etc. because if the investment wasn’t well picked out it may result in financial difficulties, depending on each individual’s circumstances.

- Further, if we have a fear that is holding us back from becoming better investors, we should overcome that fear so that we can get invested in the opportunities that will realize our goals

- Another differentiator they bring in of the three investors, is how they invest their money and their time:

- Category a – invest no time & invest no money

- Category b – invest no time & invest money

- Category c – invest time & invest money

- By investing time into our education and obtaining better knowledge we can find out ways to solve the problems that will lead us to achieve our goals

- The next advice from the book is to invest in assets/projects where you can exercise control over the investment. If you have control over the asset you can become involved to solve any problems that may be causing the asset not making returns. Thus, active investors prefer such investments where they can help the asset to solve its problems, and get back on track.

- In the next two chapters he talks about the importance of using both sides of the brain (left = logical, and right = creative —> because problems aren’t straight forward so we need to flexible and creative), as well as to think about big assets that will actually grow our portfolio.

- Thus, we need to be creative; and

- Think big (expand)

To summarize, the topics that were discussed in the preceding chapters were (1) you, (2) leverage, (3) control, (4) creativity, and (5) expand. Following through on these areas, it seems to them that it is (6) predictable that one will become financially better off.

Part 3 talks about what each author learned from different people/events in their life. They have broken this down to what they learnt from two people (your parents) and five events (school, military school, sports, business, religion), and thus makes up the next seven chapters.

- What is evident is that schools only prepare us for the Employee Quadrant, and not the B or I Quadrant. Thus, both authors agree that it is up to us to improve our financial education if we wish to change our circumstances, or even switch from the E-Quadrant to another Quadrant.

- What they say they have learnt from military school is that being unprepared for combat (or any situation) is more risky than being prepared. Thus, by putting in time to learn (and educate yourself) you reduce the risk that you are exposed to.

- Another few things Robert notes he learnt from military school are:

- Discipline

- Focus

- To serve a mission greater than our own self-interest

- To take orders, follow orders, and give orders

- To control ones fears and ones anger

- To study and respect your enemy

- To trust your fellow soldiers and be willing to give your life for them, so they may be willing to give theirs for you

- To be prepared before going into battle

- What they say they learnt from sports was that in order to achieve results, the only person that could make them achieve those results was they themselves. Thus, they need to change their Thoughts, which would bring them to change their Actions, and in turn would change their Results.

- The lesson that was learnt from business was that books and seminars introduced you to new ideas, and new ways of thinking, but learning how to actually run a business would require a hands-on approach

Part 4 they bring out some ideas for real life people. Now, to understand why they give the advice to the different people mentioned in the next five chapters you would actually need to read the first part of the book, because there they elaborate why they want people to better their financial circumstances, and then in this part they step into the shoes of different people to illustrate that changing your life can still be possible.

- Next, we get to the part where they give their advice on what they would do if they were in other people’s shoes. Which includes:

- Accepting that making mistakes is part of the learning process

- Learning doesn’t stop once you have attained your school or university degree. They provide you with an entry point to certain professions, but you still need to learn more along the way.

- Learn to think for yourself and solve your own problems (by reading business books, business magazines, gaining an understanding of the economy, etc. )

- Determine if you want a simple life or a complex life, and then plan to make that lifestyle your future

- Simple life – living below your means

- Complex life – find solutions to problems to help you live the life your have a dream to achieve

- Taking stock of your life and determining whether you are on the expected standard for someone of your position in this life, or if you are falling behind the market (and thus need to catch up)

- Invest in your health

- Invest in what you know/understand and and what you love

- The final chapter of this part looks at the question, why some people who want to become rich, don’t succeed to become rich

- One argument is that the dream is there, but they are not living in an environment where it supports and nurtures the person to grow and pursue that dream, thus they lose faith to follow through

- A suggested solution to the problem, is to identify your goals (health, reading more, etc.) and then find an environment where you can exercise that goal (ie. read at the library, ride a bike, etc.) thereby, taking action yourself to get out of the unproductive environment, towards your goal.

- Therefore, if we aren’t brought up in such an environment, it becomes our responsibility to become a part of such an environment if we truly wish to attain the goal

Part 5 is broken down into the final four chapters, where they finalize their case on why they think it is a good idea to invest in the areas that they have invested in.

- The important message to get things going, and carry on going, is to remain focused, and never lose track in any circumstance

Summary:

After getting through the whole book, and now after also summarizing the highlights of the book, my view is clear that the book imparts the importance of taking it upon oneself to better their circumstances, and not rely on anyone. The book combines the thoughts, opinions and lessons from two successful business individuals and states the importance of the underlying message. The lessons are very clear to follow, and thus make it easy to follow and comprehend. The book deserves a strong rating of 4.8/5

Have a great one!